This year I even added fun apple cups with apple cider for our trip so we could have a yummy drink for our journey!

Nebo Loop runs from Payson and comes out in Nephi. I love this canyon in the fall. So beautiful. This year we went a little early so there weren't as many reds but I recommend a trip to all.

This year I even added fun apple cups with apple cider for our trip so we could have a yummy drink for our journey!

0 Comments

1. Keep good records! If you want to buy a home your lender is usually going to need Tax Returns, W2s, recent paystubs & Bank Statements. Start getting these things together!

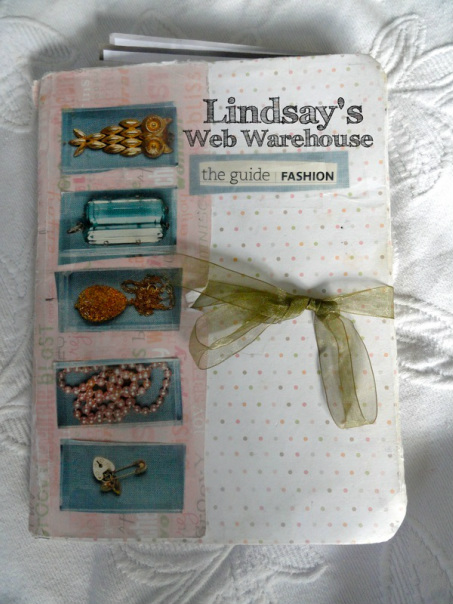

2. Get pre-approved before looking. What does this mean? Go to your desired lender and ask for a home pre-approval. They will then pull your credit and ask some income information; based on that (your credit/debt & income) they will give you a pre-approval letter stating how much you qualify for. For example Jake & I qualified for 130k in our letter. If you do not qualify check out my earlier post "15 things I learned about Credit" for some tips to improve your score. Most Realtors will want you pre-approved before you look at houses and pretty much 100% of sellers what to know you are pre-approved before you can even put in an offer on a property. 3. Don't look at houses you can't afford & go evaluate your costs. Talk with your mortgage officer about possible payments for different loan amounts. Keep in mind they will probably only be able to quote you a principle and interest total. You may also have mortgage insurance & escrow* (see below for more) included in your monthly payment. AND you need to keep in mind you will have monthly utilities separate from your mortgage payment; water, sewage, electrical, gas etc. Go over closing costs with your lender as well; how much are you going to have to bring to closing? Continuing with my example; Jake and I qualified for 130k but I was more comfortable with the $120,000.00 monthly payments; our principal and interest payment is $533.40, mortgage insurance $28.00 and escrow $158.00=$719.40 as our mortgage payment. Including our utilities we pay around $1,000.00 a month for our home. We lucked out and qualified for a Rural Housing program that did not have closing costs. We had to make an earnest money payment of $1,200.00 but we were able to get it back after closing. 4. Get a good realtor. When we first started looking we used our current landlord who was a realtor. BIG MISTAKE. Don't do business with friends. He was awful. I would be up til 11:00 at night writing up our proposal to the sellers. Just so you know, this is not your job. Our next realtor did all the paperwork, explained the back and forth between the seller and, did the running around; which is their job. 5. Don't let your Realtor pressure you you. Find a Realtor you like but also remember that their job is to sell you something. Don't be pushed into a home too quickly because your Realtor thinks its "awesome!" or because you feel bad you are wasting their time looking at so many houses. Again, thats their job. They will deal. 6. Make a list of what is most important to you. What has to be in your home? 7. Be patient; your dream house is out there! I remember feeling so discouraged while we where looking for a home. Everything we saw had a laundry list of things that I didn't like. I started to try talk myself into some or compromise when I was feeling desperate. Then we found our home. There are still things that we need to fix, its older, and small but I love it! Let yourself fall in love with your house! 8. Test the key things; plumbing, electrical & temperature. Test the water pressure, turn on the faucets and flush the toilets. Do the switches work? Heating & cooling? If these things are on the fritz life is going to be uncomfortable. If your still really interested bring in your home inspector once you've made the offer. 9. If you find a house that you want put in the offer as soon as possible. I'm not sure the housing market will be same in a year from now or 10 years but right now with the low prices for homes there is a lot of competition between buyers. There are also a lot of investors buying up properties for rentals. We almost lost our house to another buyer. 10. Get a good home inspector. Seriously. I love our home but I wish we would have had a better home inspector. We had a great inspector for the first house we put an offer on, I need to find his number... He had an 80 page report! He got in all the crawl spaces, on the roof, everything! He found a lot of mold which prevented us from purchasing. The guy we went with for our home was recommended to us. He was a joke; he had a 3 page punch report, didn't even get on the roof and he missed so many things (check out my "Water, Water Everywhere" earlier post). Both inspectors charged around $300.00 11. Be kind and courteous to your sellers; You want their house so don't drive them nuts. I understand that there are some things you can ask be included or fixed by the seller but don't be unreasonable or they will sell to someone else. You will most likely go back and forth negotiating a your purchase contract before you both sign it and send it to your lender. 12. If you want something included get it in writing. You must make sure your realtor specifies in the negotiations if you want something included; this includes appliances! Sellers can legally take their stove, dishwasher, fridge, washer/dryer etc. with them because they are not attached to the home. If you want something or have talked about including something with the seller get. it. in. writing. 13. Find out who your Home Owners Insurance will be through. Shop around; call a couple insurance companies and compare quotes based on amount, coverage AND customer rating. They will need information on the home so know the details; square footage, flooring, bedrooms, bathrooms, foundation type, heating/cooling, garage/carport etc. 14. Get your documents to your lender asap. I'm not going to lie, no matter who you go through the lending portion is not going to be fun. There are so many early disclosures to sign & documents to fax in even before you are closing. Roll with it. The process will usually take 30-45 days from the time you have a complete sales contract and documentation submitted to your lender. The quicker you get those things to your mortgage officer/broker the smoother things will be. 15. Don't fight with your lender. Working at a bank I've noticed that the clients that want me to fight underwriting on getting a document (they don't have it, or don't want to look for it) takes so much longer. AND its usually denied. Your lender can be your advocate and fight for you but there are some things that underwriters just need. I wouldn't recommend waiting and hoping your lender can convince underwriting otherwise. Make the process easier on yourself by just getting your stuff together. *Note on escrow from #3; Most people also choose to have escrow (your taxes and insurance) included in their monthly payment, instead of paying it on their own. This amount will be on top of that principle and interest payment. Escrow is calculated by taking your annual premium for homeowners insurance and your annual premium for your taxes and dividing it by 12. I decided I needed to share my fashion inspiration notebook today. I have had quite a few friends comment on what a great idea it is. Basically I have compiled my favorite outfits, hair, jewelry etc in this cute little notebook. This is before I had heard of Pinterest (its very similar by having your inspiration assembled) but I actually like it better, call me old school. Below I have a slideshow of a couple of the pages in my book. I have a combination of magazine print outs, sketches and print outs. Here is how you make your own notebook... What you'll need: 1 Composition notebook Tacky glue 2 8"x11" matching scrapbooking or design paper sheets [cover & back] 1 8"x11" different scrapbooking or design paper sheet [binding] 2 8"x11" matching solid colored paper sheets [inside covers] 2' of ribbon Start by gluing your 2 matching scrapbooking paper sheets to your front cover and back cover. Make sure the paper is centered, fold over any excess paper to your inside cover and glue. On my notebook theses papers are multicolored polka dots [see below right].

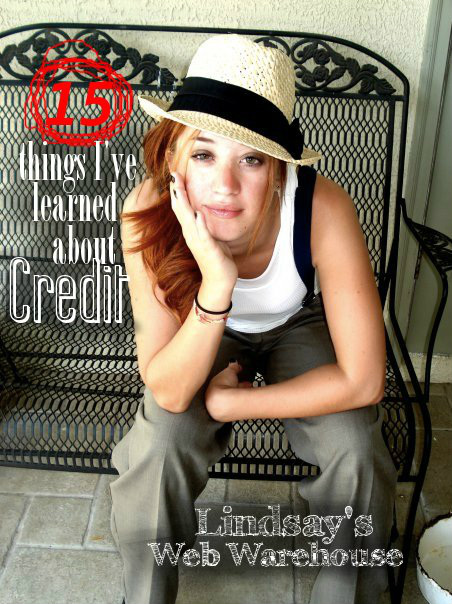

1. Score doesn’t mean everything; Yes, lenders look at your score but you can have a good score but your loans may be too new, or you don't have anything current. Also, you may have a moderate score but you may have a recent late payment etc.

2. You should have 4-5 credit product reporting to your credit. This should be a mix of credit lines (i.e. credit cards or revolving lines) and installment loans (i.e. auto loan, mortgage or loans with a fixed monthly payment). 3. Store credit cards (JC Penny, RC Willey, Sears etc) are weighted less then Bank credit cards. They aren’t terrible but you shouldn’t have a lot of them. You should also have more Bank credit cards than store cards. 4. Credit cards aren’t evil; They need self restraint but they can actually give you a reward! I use credit card my like I would a debit card; we pay for gas, groceries, meds etc on our card and pay it off with my checking account in full every month. I get cash back for all my purchases, BONUS! If you don’t have self control get your credit card, activate it and shred it. 5. Late payments kill; pay your stuff on time. Period. Its not worth it. You could have a late payment from 6 months ago still prevent you from getting the loan you desire. 6. Collection accounts kill; collection accounts stay on your credit for 7-10 years AFTER YOU PAY THEM OFF! Find out if you have them on your credit and start a payment plan. It will improve your credit once they are paid but slowly. It will dramatically improve once they “drop” off. 7. Debt to credit is important, meaning, you want to keep the balance on your credit cards at a 1/3 or less of your total limit. For example, I have 2 credit cards with a $1,000 limit each and one credit card with a $2,000 limit. I want to make sure the total balance between the three of them is $1,300 ish or less ($4,000 / 3 = $1,333.33). Got it? 8. Debt to income important, meaning, you want your monthly debt (monthly payments for your Mortgage, auto loans, credit cards etc.) to be 45% or less than what you earn monthly. This only includes your loans/lines reporting to your credit. 9. Cell phone, Insurance, Utility payments etc. do not report to credit. 10. Bankruptcy will take you typically 2-5 years to recover enough from for you to be able to borrow again. If you have any late payments or collection accounts after you file bankruptcy you will probably not be lent to for a very long time 11. It doesn’t matter how much money you make, if you can’t pay your current obligations on time or at all no one will lend to you. You could be a millionaire but if you have a bunch of late payments on your auto loan we don’t want to lend to you either. Makes sense, right? 12. You want to limit your inquiries on your credit; a bunch of inquiries tell the bank that you are desperate for money (desperate doesn't flash good in the mind of the Bank). It also means you may have new debt on your credit that has not reported yet. 13. Auto dealerships will send your credit information to several different Banks and Credit Unions until they get the best offer (i.e. LOTS of inquiries). If you go through a dealership for your auto loan you will want to wait awhile before your pull your credit again. 14. Lenders are required to report to the credit bureau every 30 days (when you statement cuts) but the credit bureaus, Experian, Equifax & TransUnion, are only required to update every 90 days. If you recently paid something down or off you may need to wait three months from your next statement for it to show. 15. When you find a lender you trust stick with them; I have found that to keep up competition most Banks and Credit Unions have comparable interest rates. What may not be comparable is service. If you are receiving excellent service from someone and feel comfortable with them stick with them! We have mice!

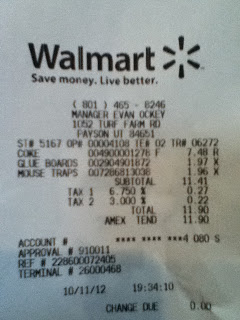

I could die. I think we are getting the full scoop of "welcome to home ownership" pie. Blah! We noticed them right around the time the pipes burst in January so we got working on getting them out of our house. I thought that we had beat them but I recently found, whats a nice way of saying this?!, droppings. Again. Luckily mouse traps & poison is relatively cheap. We have had the most luck with these "Catchmaster" sticky pads pictured above [far right]. If you notice from my receipt they are $2 for a pack of 3. Side note; check your traps frequently! If you catch a mouse on your sticky pad get rid of them immediately. If you are lazy, yes I am speaking from experience, they will actually try to chew their own legs off to escape. How is that for a vivid picture? Gross. Oh, and they may seem cute at first but they are not. They poop everywhere. Chew on everything. Climb on places you would think they couldn't reach. Nothing is safe. Next on our list is to go around and try to seal any areas around our home were they are getting in. Lots of work! Hopefully you all live in mice free home.

Referencing my last post, Plumbing, our house had flooded. By the time we got the water turned off and started scooping water out it was late. Jake and I were tired and irritable but something needed to be done. So naturally, I called my mom. I'm a momma's girl. Our carpet and tile still had about an inch of standing water; we had to get someone out. Our State Farm agent sent out Complete Restoration to work with us on the water extraction. Complete Restoration brought in machines to soak up the majority of the water; we had hoses running out our windows and through doors that ran back to their huge truck. It took several hours to suck up water. They took off baseboards and drilled holes in the drywall underneath so that they could test how much water got in the walls and to dry it out. They also brought in large industrial fans to dry out the rooms. The fans run for 3-5 days along with another machine that is used to take humidity out of the air.

The water extraction team was great at getting the water up the first couple of days. They did forget about their fans though. We figured they would come back and turn them off when they thought it was done but we ended up having to call and remind them. The constant running of the fans for those couple of days shot the electricity bill in the air; $343.60; usually around $100-$150 in winter months. Lucky for us State Farm was great, they included that excess electric bill amount in our claim deductible ($1,290.00.

Because of the goober that I am I had to go around and do a happy dance in each of my “new” rooms. Imagine a spunky red head dancing from room to room; it makes the next part better... Now imagine, since we have our "imagination hats" on, the thudding halt, draw drop and eye widening as I come to my guest bedroom and find grass, let me repeat, GRASS, growing out of my carpet. I had to pluck it out. At this point I was trying to decide wether to laugh or cry. I ended up doing this kind of insane hysterical hyena outburst. I may have been partially mad. Jake and I aren’t by any means rich. We make good enough money, the bills get paid and mouths get fed but we don’t necessarily always have money in our savings account. This was one of those times. We called out a plumber who ended up ripping out the carpet just to say that he wasn’t sure where the leak was or if there was one. He thought water may have been tracked in...along with grass seed? Life went back to normal. Moving to a house was a big adjustment; we went from living in a 1 bedroom basement apartment to a 5 bedroom, two level home. We didn’t need really go in that guest bedroom. Next thing I know I noticed some fungus growing out of the baseboard in the room one day with a little wetness to which I just peeled off and thought, “that probably isn’t good” and went back to my chores. Let me just pause to say that I know that I’m gross. Well aware. I am also busy. I work 9am-7pm (five to six days a week on varying days) and Jake works 11pm-7:30am. We finally did call a plumber back in. I decided it was kinda a good idea once I pushed against the wall and my finger went through. Yes! Super strength? ...not really.

Then we had a ridiculously cold winter. The smart thing to do, for those reading, would have been to re-insulate and drywall the gapping open wall. We didn’t do that, because that would have been the smart thing to do. Side note; you will soon realize that I am super sarcastic. I apologize ahead of time. The cap froze and burst a second time. Yeah... Are we learning life lessons here? Nod. Yes. This time we didn’t find out until a lot more damage was done. We bought and extra heater to put in that room which caused the frozen water to thaw and flood over morning/afternoon. I came home to Jake yelling out the door to me that we had a "problem" and that I had better come in and help. My sweet hubby, "problem"? ha more like catastrophe! Lets just say its good he found it. I would have been the one scream hysterically running around like a chicken with my head cut off. Lucky neighbors, huh? It flooded 3 rooms! We called a plumber out again, I different one named Don Henrie, and he advised us to get a “shark bite” for us to replace the cap ourselves. Gen-ius! Jake and I were doing a happy dance at our handy-ness. Sadly it was short lived when we realized we had acquired several other leaks when we turned the water back on. By the way if you by a home, know how to turn off your water. VERY IMPORTANT. Don Henrie, our plumber, came out and did twice the work as the first guy and charged us $150.00 Love him!

|

RSS Feed

RSS Feed